Now Students and Citizens may know how to open SBI account online with onlinesbi.com. Find detailed process and requirements for SBI new account opening online who wish to create banking products from own hands…

State Bank of India is the largest bank in India which does have branches in most part of country. The bank does have over lakhs of active customer with supporting their daily financial transactions. Online banking system is seen to be overtaking the manual works which even includes the bank account opening opting.

The truncation of State Bank of India can be processed through the official website of SBI, which does give a user-friendly option to their customers.

In recent times, account opening has been made easier, as the first stage of application filing and document submission has been entirely online. Customers can submit all their details through the online account of State Bank of India and get their new account open in quick time. This new account provides NEFT, SBI RTGS, other payment options and all as usually like branch account.

How to Open SBI Account Online

State Bank of India does provide an easier way to open the account from online official portal. Make sure you follow these steps and get your account open in SBI.

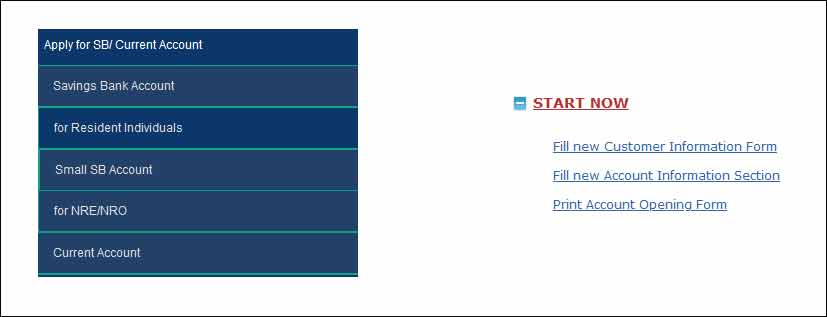

- Visit official online portal of State Bank of India from onlinesbi.com. Click on Apply Online and wait for options to display on screen

- Select Account for Resident Individuals or for NRE / NRO

- Select Small Savings Bank Account for all including Students / Individuals

- Find the account application process, benefits, information

- Tap on Fill New Customer Information Form

- Provide Personal Details along with KYC Information

- Note down SCRN to link customer Account Opening Form

- Enter all the financial details, Required branch code on selection along with mobile number and required facilities

- Submit the form to attach documents

- Upload the documents and submit the form and note down reference number generated

- After successful completion of data entry, an SMS notification will sent on account holder mobile number.

- Print the Account Opening Form Submit application at the branch for activation immediately.

That’s it, Once the KYC has been confirmed, the State Bank of India account with the information provided will be activated and the account will be able to work within 48 hours of the first deposit made by the account holder.

Also find: SBI Net Banking

SBI Account Open through SBI Yono App

SBI Yono is the official mobile application from the State Bank of India, which provides all banking services to customers at their fingertips. Follow the below guide to get your SBI account open form SBI Yono App.

- Install the SBI Yono application from iOS or Android Play store

- Now launch the App and then tap on Apply online option

- Select the Type of account from drop down and proceed

- Fill your information and enter the mobile number

- Verify your number with OTP and then submit the details

That’s it! The State Bank of India Account opening through SBI Yono App has been submitted, and the customer has to visit the SBI branch for their document verification.

Also read: SBI Balance Check Number

State Bank of India Account Opening Documents

A customer who is going to open the State Bank of India Account online, must have the below said documents for their verification purpose.

- Account opening Online Filled Application

- Passport or Driving License

- Voter ID or ration Card

- Aadhaar Card

- PAN card

- Latest passport size photograph

Also find: SBI Credit Card Payment

State Bank of India Account Opening Kit

Once a customer has opened their State Bank of India Account online, the customer will be provided with the State Bank of India Account kit as a new customer.

- State Bank of India ATM Debit card

- Cheque Book containing 10 leaves for Minors

- Instruction of State Bank of India

Also check: How to Change Mobile Number in SBI

SBI Online Account Eligibility

An individual has to go through the list of eligibility points to open the State Bank of India account, which are mandatory while applying.

- Customer should be citizen of India

- The customer age should be above 18 years as of date

- In case of minor, parent or guardian should open the account

- Government identity proof for verification

- Address proof for Address verification

- Minimum Account Balance amount

Also check: SBI Forgot Password Reset

State Bank of India Account Services

State Bank of India is a nationalized bank and it always tries to bring convenience to the customer by the below listed features.

- Mobile banking facility

- SMS alerts option

- Internet banking Facility

- Yono Banking option

- State Bank Anywhere for paying fees

- SBI quick facility for missed call

- Restricted free withdrawals on monthly average balance

- Nomination facility for members

- Zero balance account facility

- Maximum amount facility to unlimited

- Passbook to record the transactions

- Every month, consolidated account statement

State Bank of India does give multiple options to get their customer account opened through online. Here we bring you the detailed guide to open an account in SBI.

Also read: SBI Corporate Banking Login

State Bank of India Account Types

There are multiple accounts which the State Bank of India does offer to their customers, which can select from the list as per the understanding and usage.

- Basic Savings Bank Deposit Account

- Basic Savings Bank Deposit Small Account

- Saving Bank Account

- Savings Account for Minors

- Savings Plus Account

- Motor Accident Claim Account

- Resident Foreign Currency Account

- Salary Account

- Current Account

The details of each account can known through the online SBI official website. The individual has to select the account and wait for the features page to load, which does contain all benefits and information for the select account type. For more details, please visit oaa.onlinesbi.sbi/sao/onlineaccapp.htm

How soon will the State Bank of India Account be activated?

The soon after the customer has submitted their KYC document offline at the verification process. The account holder will be asked to deposit the minimum balance in the new account which does make the State Bank of India Account active. The account process will hardly take 24 hours form time of document submission.

Does the State Bank of India charge an extra cheque?

The bank does charge minimum charges of Rs 40 to Rs60 for the extra cheque request form State Bank of India. The request for new cheque can be raised form online internet banking page or through visiting the branch with the account passbook.

What happens if I don’t maintain SBI Account Minimum Balance?

If your account is not in list of zero balance, then the State Bank of India will have their customers to have minimum balance always available in their account. In failure to maintain the minimum balance, the nominal service charges will be deducted from your account balance.