Find out how national insurance claim intimation has been done during the cause of accident, Where we find national insurance claim form, How to Check national insurance claim status after applying for claim…

National Insurance main business portfolio is Motor. For customers convenience National Insurance has launched online claim intimation service in their website 24*7, and also online tracking of their claim status in website or mobile Application.

| Company | National Insurance Company Limited |

| Customer care number | 18003450330 |

| SMS Number | 56767556 |

National Insurance Claim Settlement Ratio

National Insurance Company is one of the best Company in General Insurance Companies in terms their claim settlement process. National Insurance company has around 95% claim settlement ratio.

All claims are handled by Insurance offices only except health claims. Health claims are handled by Third Party Administrator (TPA), however payment release will be done by Insurance company only.

Except motor claims, remaining all department claims like Fire, Engineering, Marine, Personal accident claims etc has to be intimated at nearest National insurance office or to the policy issuing office.

They will arrange spot survey immediately to access the admissibility of claim and extent of damages. Once spot survey finished you have to intimate claim with supporting documents and claim form in office.

National Insurance Claim Intimation

Mainly national insurance motor claim intimation has done in following two ways

- Online Claim Intimation

- Claim Intimating at nearest office/ Policy issuing office.

Online Claim Intimation

Online Claim intimation can be done in two ways

- By calling Customer care

- By sending SMS

By Calling Customer care

After accident occur immediately, we have to intimate the claim to Customer care 18003450330. Following details should be in ready with the person while calling the customer care.

- Policy Number

- Vehicle number

- Driver name

- Place of accident with Pincode

- Nearest landmark

- Any injuries to the person/death due to the accident

- Vehicle should not be moved more than 500 meters from the place of accident. Once spot survey has been done surveyor let you know detailed list of documents which are to be submitted in office.

By sending SMS

National insurance launch new facility of intimating claims through SMS facility. To intimate claim just we have to send a message “MOTORODCLAIM POLICY NUMBER” (example: MOTORODCLAIM 123456789123456789) to 56767556 from the registered mobile number.

A link will be sent back to you and you to fill the all required data and submit. Claim registration details will be send to mobile number and email Id provided in the policy.

To submit all the required documents, you have to visit nearest office with the claim intimation details given in the email or SMS.

Claim Intimation at Nearest Office/ Policy Issuing Office

Immediately after incident occurred, we have to call nearest office or policy issuing office for the spot survey. Once spot survey has been done surveyor let you know detailed list of documents which are to be submitted in office.

>>> National Insurance Renewal

National Insurance Claim Intimation Documents

Following documents has to be submitted along with the claim forms for processing of claims.

- Registration Copy

- Driving License

- Policy copy

- Permit (In case of goods carrying vehicle and passenger carrying vehicle)

- Fitness Certificate (In case of goods carrying vehicle and passenger carrying vehicle)

- Load Challan (In case of goods carrying vehicle while carrying goods)

- FIR or Police certificate.

Based on insurer and severity of damages insurer may request for additional documents for smooth processing of claims.

>>> National Insurance Forgot Password Reset

National Insurance Claim Status

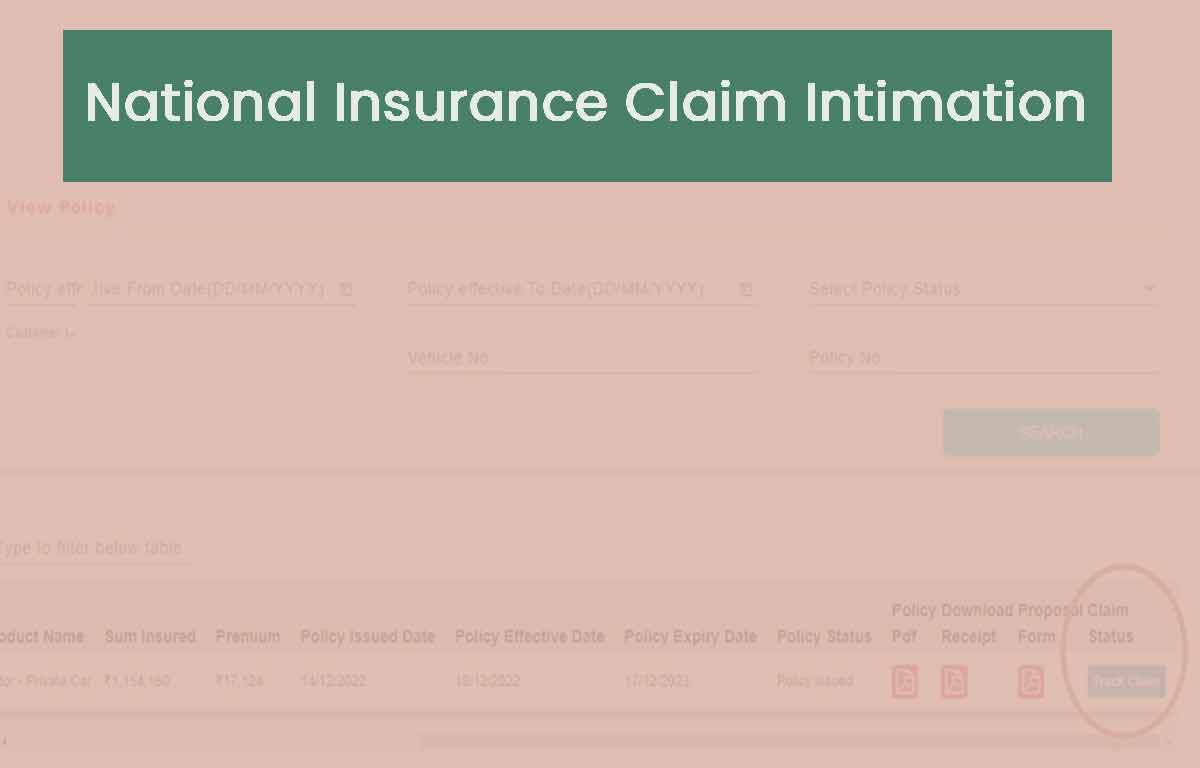

After successful intimation of claim we can track status of the claim online by logging into national insurance website or logging into mobile application.

Through National Insurance Portal

- Visit the official website of National insurance company https://nationalinsurance.nic.co.in

- You will see home page. In the right side More option will be available. Click on it.

- Click on National Insurance Customer Login

- After logging in enter the policy number in given field and click on search.

- Searching the policy in which claim is intimated go to bottom right end of the screen.

- You can find claim status option, click on track claim.

- Then separate page will open and you can view your claim status.

Through NIMA Mobile App

- To use this app First You have to download and Register to NIMA app.

- Login to App and It will show you NIC portal.

- Then NIC Portal Screen will open. Now you can see Home page.

- Enter the policy number in given field and click on search.

- After searching the policy in which claim is intimated go to bottom right end of the screen.

- You can find claim status option, click on track claim.

- Separate page will open and you can view your claim status.

National Insurance Claim Forms

Claim Form is a document which is to be filled by insured to intimate the details of accident/loss in claim form. It contains all the data in detail related to accident/loss.

National insurance mediclaim claim form are used for a reimbursement claims. It means when a patient under gone treatment in a non network hospital ( Not attached to TPA) has to submit mediclaim claim forms to nearest branch office. In this claim form two pages will be there one is to be filled by insured and the other one is to be filled by hospital where patient undergone treatment.

For cashless claims request will be sent by the hospital in a single page format for approval to treat the patient. Patient need not to fill anything for cashless request, everything will be handled by network hospital.

Discharge voucher is a form to be submitted to insurer by the insured for agreeing the payment of claim amount which will be transferred to insured account by EFT or by Cheque. A one rupee revenue should be affixed and insured has to sign on it.

Claim intimation is a form to be submitted at office by insured/insured representative to intimate initial data of loss but it is not in detail in claim intimation form.

Whether FIR required for all types of claims?

Mainly FIR required for accidents where third party involvement will be there and also for high value claims. For small value claims most of the insurers may not ask for FIR but cases may vary from insurer to insurer.

Whether claims have to be intimated immediately?

Yes, claim has to be intimate immediately to the nearest office or customer care. But cases may vary from insurer to insurer and depends upon the accident.

Whether Claim has to be intimated by the insured or any other person?

Intimation can be done by any person. But while submitting the documents claims forms should be signed by insured only. In case if insured died in the accident then legal heir can be signed and submit the documents along with legal heir document proofs.