Complete your income tax payment online carefully within due date. Know the requirements and check the process to make Challan No ITNS 280 online payment with different modes for payment…

Income Tax payment has become mandatory for everyone who runs a business, salaried or non salaried employee who generate revenue monthly. In this aspect, if you are a salaried employee then you would not have to worry about this since your company will deduct your taxes using TDS. You do not have to make Income tax payment again since taxes are deducted at source for salaried employees.

In the case of self-employed, people either run a business or earn through different means they have to make income tax payment. For such people who want to make their Income tax payment we have written this article. This will help you identify the requirements and the payment process.

Requirements for Income Tax Payment

To pay your income tax, you will have to follow below requirements as instructed by Income Tax Department of India.

- If you want to make your Income Tax payment online. You will only able to use as a your debit card or internet banking to make the payment

- You will have to note that you cannot use your credit card to make Income Tax payment

- If you don’t have a debit card or net banking, enter your name, then you can also make use of your friends

- A spouse or any family members account details to complete your payment

- Though you are eligible to make payment through offline but it would eventually require you to fill Challan number 280. This is why completing the transaction online is better.

Income Tax Payment Online

So in order to complete your Income tax payment using the challan 280 then you can follow the instructions mentioned below.

- Open the Income tax department tax information official website from here https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

- Go to the Challan 280 section and under this tap on the proceed button

- It will essentially be required for individuals who are self salaried to make the income tax payment

- Click on proceed and complete filling within 30 minutes

- After clicking on the proceed now you will be on the personal details form filling pages.

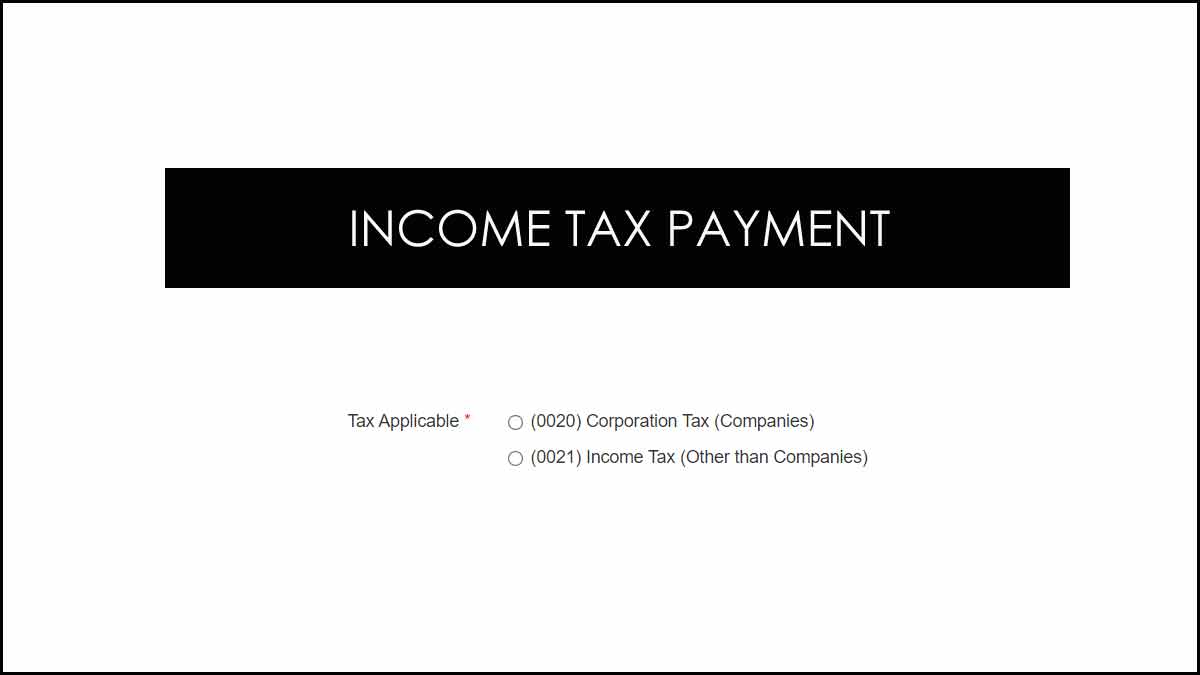

- Find the option 0021 for Other than companies and 020 for companies

- Select the type of payment from the given options below and you simply have to check the payment type

(100) Advance Tax

(102) Surtax

(106) Tax on Distributed Profit

(107) Tax on Distributed Income

(110) Secondary Adjustment Tax

(111) Accretion Tax

(300) Self Assessment Tax

(400) Tax on Regular Assessment - Select debit card or internet banking (you may use either your details or your friends, spouse or family as well)

- Select Assessment Year

- Enter Address and Captcha

- Click on I agree and Submit to show the preview of details and to submit to the bank. You may redirect to your selected bank payment gateway

- Make the payment through your selected payment gateway and complete the Income tax payment online

For more information, please visit incometaxindia.gov.in/Pages/default.aspx

Income Tax Payment using Challan 280

Challan 280, a simple form provide by Income tax department through which employee TDS not deducted or those people who are self earn can file Income tax payment online.

This may understood that everyone has to pay their taxes. But using the proper means and process is what makes your tax payment acceptable. This is why if someone falls under category of self earning. Then they surely have to make use ITNS Challan 280 to make payment online.

You can either follow this article to completely fill the challan 280 from online. Make the payment through debit card or net banking through your selected bank. Else you can even download the ITNS challan form 280 to fill it offline. Then submit the payment offline as well. But the only method prefer since payment may made quicker.

Can a salaried employee pay Income Tax Online?

In most of the cases, salaried employees will have their taxes deducted before they receive their salaries. It means, your company will pay TDS which means Tax deducted at source to the Income tax department from your salary already. That is why salaried employees do not have to pay taxes.

How can I download Challan 280 receipt?

In case if you prefer to fill the ITNS challan 280 and make the payment offline then you can download the form from here https://www.incometaxindia.gov.in/Forms/107010000000345598.pdf. And then take a print out copy of this file which will allow you to fill it and complete your payment.