In this article, we will learn more about what is Internet banking along with its advantages and things customers should be aware of while using net banking for safer transactions online…

In this modern day, financial transactions need to occur in a span of moments and that is possible only with the use of Internet banking. Customers can access financial services and manage their accounts online through internet banking, sometimes referred to as online banking.

Someone might say why is Internet banking so efficient, it is so because you can use it without needing to go to a physical bank office, you may carry out a number of tasks using online banking, including checking account balances, moving money, paying bills, and seeing transaction history.

What is Internet Banking

Internet banking is convenient, accessible, and often available 24/7, making it an attractive alternative for consumers who like the flexibility and quickness of online transactions. When utilizing internet banking, it’s crucial to safeguard the security of your personal and financial information because it might be exposed to online risks like hacking, phishing, and identity theft.

Benefits of Net Banking

- All the banks provide free Internet banking service and registration to all their customers.

- Internet banking powered with mobile banking helps modern day customers with Smartphone for seamless transactions

- Transaction rights to access different financial services.

Internet Banking Advantages for Customers

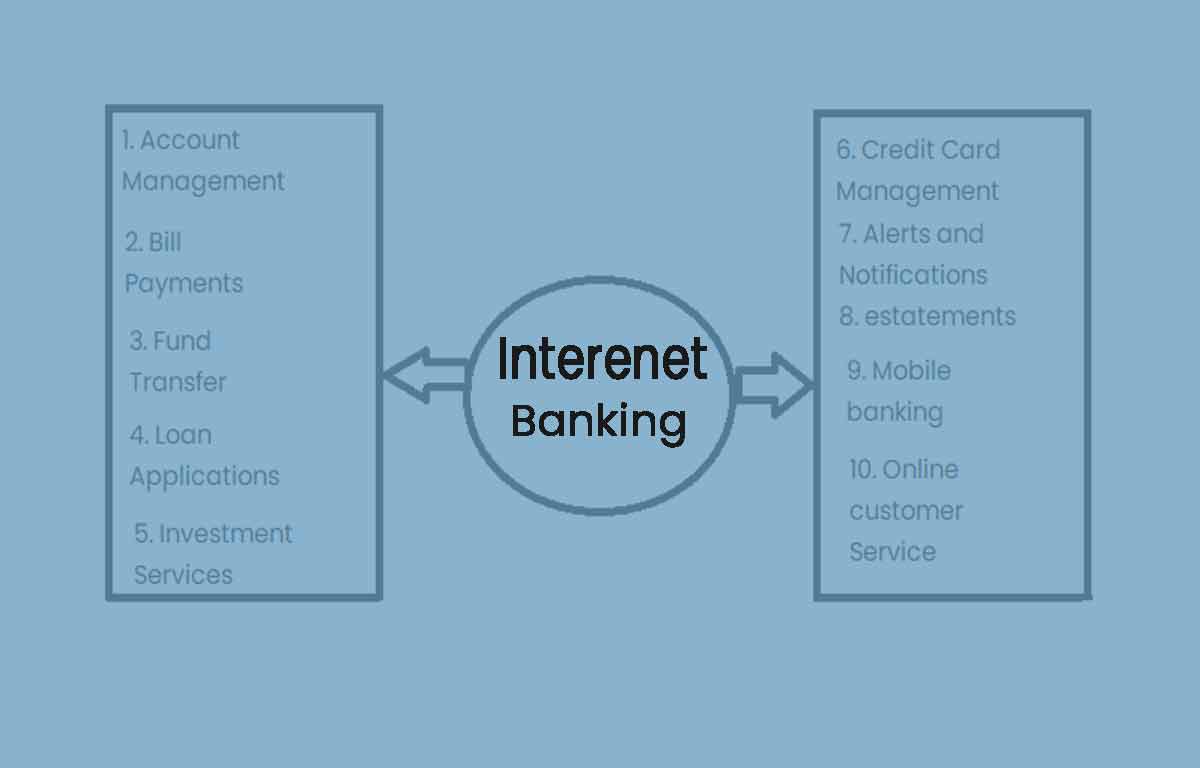

Apart from the primary benefits of internet banking, customers who use Internet banking on a regular basis do have access to a lot of advantages that will come handy regularly.

| Account Management | View account balances, transaction history, and account details such as account numbers, interest rates, and available credit. |

| Bill Payments | Pay bills online from your checking or savings account. |

| Funds Transfer | Transfer money between your own accounts or to other people through IMPS, NEFT, RTGS and Forex modes. |

| Loan Applications | Apply for loans, such as personal loans, car loans, or mortgage loans. |

| Investment Services | Buy and sell stocks, bonds, mutual funds, and other investments online. |

| Credit Card Management | View credit card balances, transaction history, and make payments. |

| Alerts and Notifications | Set up alerts for low balances, large transactions, or other account activities. |

| eStatements | View, download and print your account statements online. |

| Mobile Banking | Access your account from your mobile phone or tablet. |

| Online Customer Service | Chat with customer service representatives or request assistance with account-related issues. |

How to Register for Internet Banking Online and Offline

Now that you understand more about the advantages of Internet banking, it is time for you to glance over the steps in general and methods through which you can register your net banking account.

- Online Method: Register through your Bank official website by signing up and completing the application process online.

- Offline Method: Register your Internet banking by visiting your nearest branch account.

Is internet banking secure?

Yes, internet banking is secure, but it is important to be cautious when using online banking services. Make sure you have a strong password, avoid using public WiFi, and do not share your login credentials with anyone.

Can I access my account from any computer or device?

Yes, you can access your account from any computer or device that has internet access, but it is recommended to use a trusted device.

Is there a fee for internet banking?

Most banks offer internet banking services for free, but some banks may charge a fee for certain services. Check with your bank for their specific fees and charges.

Can I make international transfers through internet banking?

Yes, you can make international transfers through internet banking, but you need to ensure that your bank offers this service. Some banks may charge a fee for international transfers.

How long does it take for a transfer to be processed through internet banking?

The processing time for a transfer through internet banking can vary, but most banks process transfers within a few hours or the same day.