ESIC Payment now made easy with ESIC online payment service for monthly contributions. Check how to pay and download ESIC Challan receipt online when required…

Insurance has become a vital enrollment for all employees in this age and the state governments in India have provided their employees with various schemes that allow them to find themselves good plans from the state government itself, and one of the finest options of this is the security provided since the Insurance is provided by the State Government.

In this context, if employee opted for Employee state insurance, then you will have to pay monthly contributions towards insurance. This monthly ESI contribution deducts from the employee or the employee can choose to pay at their appropriate times.

| Name | Employee’s State Insurance Corporation |

| Official Site | esic.in |

| Toll free number | 1800112526 |

| Email (for Grievances) | pg-hqrs@esic.nic.in |

ESI Online Payment

If you have a regular contribution towards ESIC with a monthly plan then you would need to ensure that the ESI payment is either on auto-pay, but if that’s not the case then you would have to learn on ways through which you can make your ESIC payment Online.

In the article, 25penny.com will be going over a few of the different payment methods. This will allow any state employee to complete their Insurance payment for ESIC in a quick time.

ESIC Monthly Contribution

The ESIC is devised in such a manner that every employee can join the scheme they provide and based on the basic pay they will have to pay their monthly contribution percentage.

| Salary Range | Employee Contribution | Employer Contribution | Total Contribution |

| Less than 21,000 | 3.25% | 0.75% | 4.00% |

In this way, in case if the salary range increases then the employee and employer contribution will also increase.

Why to make Online ESIC e Payment

Well this question might come to your mind, that since is a government organization would they accept online payment? Yes, they accept online payment for monthly scheme installments now through different ESIC challan payment sources.

It has become an easy way to complete your monthly EMI dues online as it does not require much hassle and you can make the payment using one of your preferred payment methods like credit, debit and internet banking as well.

ESIC Payment Using Official Website

Now follow the simple steps shown below which will help you complete your ESIC payment through online.

- Visit official site of ESIC and Enter details

- Enter your account details under user login section, then Click on login button

- Click on Generate Challan option which will now create your monthly contribution challan

- Tap on submit button and on create challan once again

- Tap on submit and payments option and enter the amount to be paid on the challan form page

- Click on the submit button and your challan will be created. Tap on Pay Now option which will redirect you to the payment gateway where you can select between different banking services to confirm ESIC online challan payment.

How do I pay old ESIC Challans?

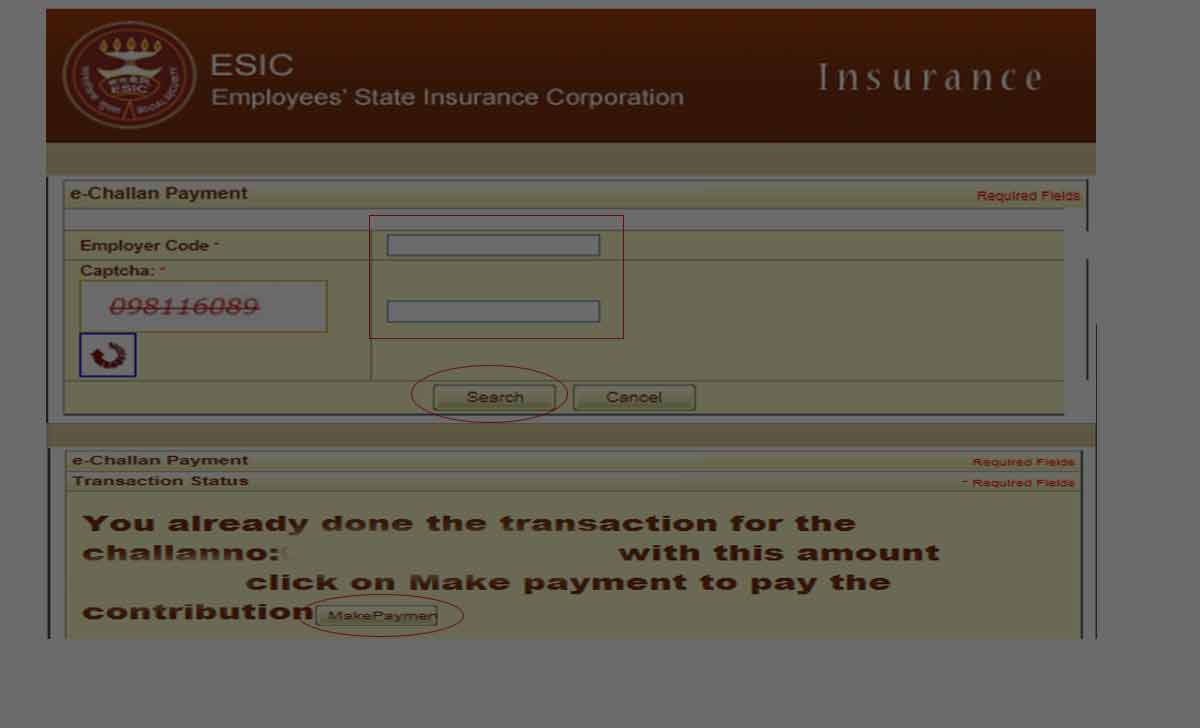

In case if you have pending ESIC challans that are yet to pay, then follow the instructions shown below.

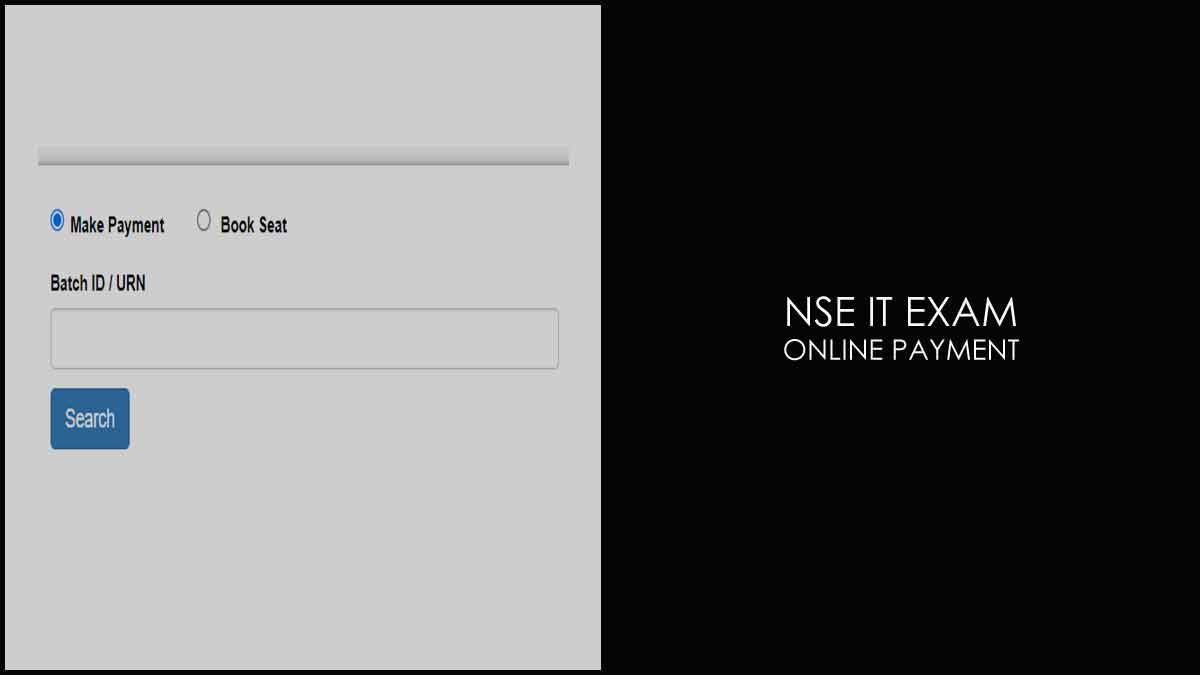

- Open the e-Challan search option, then enter employee code and captcha and click on the search option

- Under the challan table, it will show the unpaid and due challans along with their challan numbers

- Open each challan number separately

- Click on the make payment option to complete your old ESIC challan payment.

If more than the above payment process is available, we will update as soon as possible.

ESIC Payment Receipt

As shown in the above method, you can click on the view button which will open or download ESIC payment receipt in a new page in PDF format which will be your challan receipt. Here we will also provide the source of how to generate the receipt for which, you can either pay esic online using the challan number from the official website or else, use the challan printout copy to make the payment offline through different facilities available.

- Go to www.esic.in official website & login with your details

- Click on generate challan

- Tap on the view option

- The Challan will open in a PDF in new pagem save the challan receipt and take its print out

Penal Provisions for ESIC payment Delay

Here is a list of percentages which will be applied on your premium amount, in case you have missed the ESIC payment. These percentages will be applied on your total amount and will be added to your total due.

- 5 percent penalty for delay less than 2 months of period

- 10 percent of penalty for delay between 2 months to 4 months

- 15 percent of penalty for delay between 4 months to 6 months

- 25 percent of penalty for delay more than 6 months of period

Is there any delay fee attached to ESIC monthly installment payment?

Yes, in case if you do not pay the monthly installment as per the asked date then there will be a 12% interest rate over the monthly installment.

What is the rate of damage for non-payment?

The penal provision for non payment will result in damage in pa% of 5% to 25% for less than 6 months to 6 months and above.

Is there any time limit for making ESIC monthly payment?

Yes. There is time limit for any monthly ESIC payment. You have to complete payment before 15th of month to avoid charges 12% interest rate due to late payment.

Do I have to pay any penalty, if I miss ESIC payment?

The penalty charges will be applied on your payment delay and will attract a percent 12 which will be respective to your contribution amount. It is preferred to make payment earlier, to avoid the excess charges.

What is the Employer Code Number?

The Employee Code Number used in ESIC payment is a 17 digit number provided for every worker in a factory or any registered firm under the act. The employer has to use their 17 digit code to complete the ESIC online payment.

Does ESIC provide any medical benefit?

Yes, every family member of the insured will be benefited with the medical benefits as per their coverage plan. Medical, surgical, obstetric treatment and other outdoor patient or inpatient treatment are provided under these schemes.

Is there any deadline for ESIC payment?

The payment of ESIC must be made before 15th of every month and if there is a delay from these days, the applicable percent of interest will be applied in your next month due.