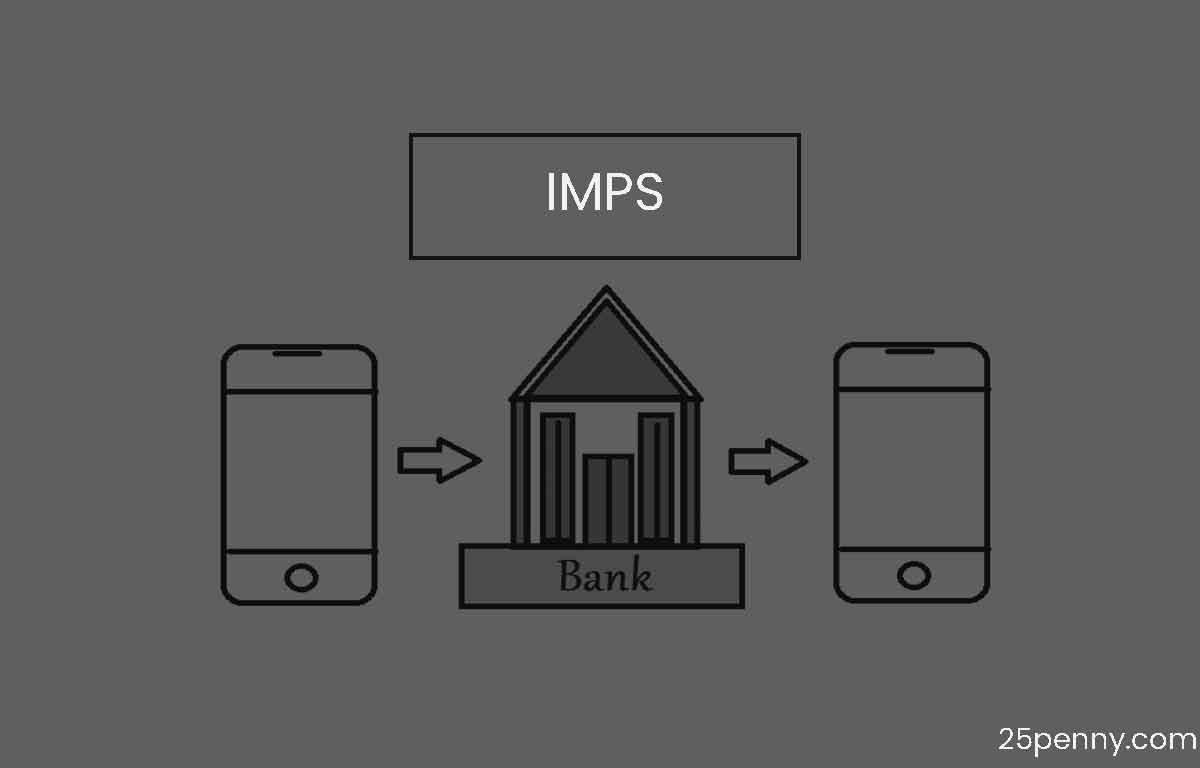

A real-time interbank electronic fund transfer service in India is called IMPS, and the IMPS full form is Immediate Payment Service. Customers can use their mobile phones or other devices to swiftly and securely transfer money between bank accounts.

It is simple and secure to transfer money with IMPS because it employs a mobile number and a Mobile Personal Identification Number (MPIN) to authenticate transactions.

How IMPS Works in Banking Transactions

Transfers from accounts to individuals, between individuals, and between accounts are among the transactions supported by IMPS. It also makes interbank transfers possible, enabling users to transfer money between accounts at different banks.

- Customers can transfer money at any time including on weekends and national holidays

- Customers can transfer 24/7 through IMPS.

- It is offered by a number of the largest banks in India and is easily accessible.

- The best and most practical way to transmit money is through IMPS because it is real-time.

What is IMPS and how does it work?

IMPS is a real-time interbank electronic fund transfer service that works by using a mobile number and MPIN for authentication.

What is the difference between IMPS & NEFT?

Is IMPS and UPI the same?No, IMPS and UPI are different services but both offer instant money transfer options.

Is IMPS transfer free?

Most banks charge a nominal fee for IMPS transfers, it is not free.

How long does it take for an IMPS transfer to complete?

IMPS transfers are completed in real-time, so the recipient should receive the funds immediately after the transfer is initiated.

Can I cancel an IMPS transfer?

Once an IMPS transfer has been initiated, it cannot be canceled. Customers are advised to double-check the recipient’s details and the amount being transferred before initiating a transfer.