You might heard about CIBIL, but the company’s full name is Transunion CIBIL which is a world renown consumer insights and metrics based platform. CIBIL stands for Credit Information Bureau of India Limited. It is still a part of Transunion where customers can find their credit information, summary, score and more details that will help to identify where they lag in their credit lifestyle to improve.

So basically all other companies, loan providers, borrowers and service share all the transactions by their customers to CIBIL. They take a consolidated track of how customers make their credit choices and decide on their score based on such activities.

Transunion CIBIL

It is well known for collecting valid information from banks, lender facilities, and financial services. Millions of customers take loans, credit cards, and more than turn those into customer information reports. These are used by other companies and services to understand the customer eligible for their credit lending service or loan service.

At the same time, the company also provides customers with a CIBIL score report. This is a report that explains their credit history profile in a score of 300 – 900.

In simple words, Transunion CIBIL terms as a company that checks your present credit score. It provides you, companies with data to make future credit decisions. It is well known to have a detailed report of past credit and financial history of all consumers with active credit participation over the time.

In this sense, the score generates used by lenders, banks, and borrowers. It is all to know the limit of your financial stability and lifestyle. With this, you can decide to either approve or reject loans, product EMI request, credit card approvals, and more.

So the CIBIL becomes important as it not only provides companies with reasoning to approve or reject your credit requests. At the same time helps you identify your credit past with ways to improve based on your present CIBIL score.

What is a CIBIL Score – What does CIBIL Score mean

Credit information report derives for each customer by CIBIL which is an explanation of all your previous loans, credit card transaction, settlements, withdrawals, backlogs in finance and more that provided detailed information on your profile which helps companies to put either a low risk or high risk tag.

But as a customer, they provide you with a CIBIL score which is a range out of 300 to 900 that defines your credit profile. Someone who has a score of less than 750 may reject from all his money requests, loan requests, and more.

On the other hand, someone who has a good CIBIL score of more than 750+ is highly likely to get accepted for home loans, lender requests and more because other companies trust your past credit history based on your high CIBIL score of 750+.

CIBIL score is useful for companies to tag and identify your profile to approve or reject for their services. While for customers it helps you understand where you stand right now in terms of your past credit transaction, what has caused low credit scores which gives you an idea to improve your CIBIL score.

Different Types of CIBIL Score Range

CIBIL Score Range is the score between 300 to 900. It explains where you stand in terms of your financial stability. If your score is low then it means you have not been paying EMI or credit card bills leads to bad credit report.

On the other hand, someone whose score is high means they have been paying their bills, invoices, loans, EMIs on time for such a score to achieve. One of the reasons why the score divides and shown is to allow each consumer to understand where they stand. It makes amends to improve their money transaction going further.

We have further divided the score range and explained what they mean.

| CiBIl Score Range | Means |

|---|---|

| 825 – 900 | Perfect Credit History |

| 800 – 824 | Eligible for all Type of Loans |

| 775 – 799 | Past History have few payment delays |

| 700 – 774 | Defaulted Multiple times |

| 300 – 699 | Not been paying EMIs on time and not been approved of any loan |

Types of Transunion CIBIL Membership? – Free vs Paid?

CIBIL score has become an important aspect of modern life to make financial decisions to buy a car, home loan or even to get a new gadget on EMI.

So, it is always crucial that you check your present score before you make such decisions, and there are two ways you can check your score: the first one is the freeway and the second is the paid membership which has different plans.

Free CIBIL Membership

In this membership, you can create your account and will be able to check your CIBIL score anytime, but you will only be able to check your score and can download your CIBIL credit report only once per year which contains vital information regarding your credit in the past.

Paid CIBIL Membership

In this paid membership you will be able to check your CIBIL score & download credit report unlimited times while you can also monitor your credit, get instant alerts on credit changes, check CIBIL score on what if situations via CIBIL simulators.

They have three plans under their Paid membership which are as follows:

- Basic: The cost is INR 550 per month where you get access to all features except alerts.

- Standard: The cost is INR 800 with access to all features.

- Premium: The cost is INR 1200 with access to all features.

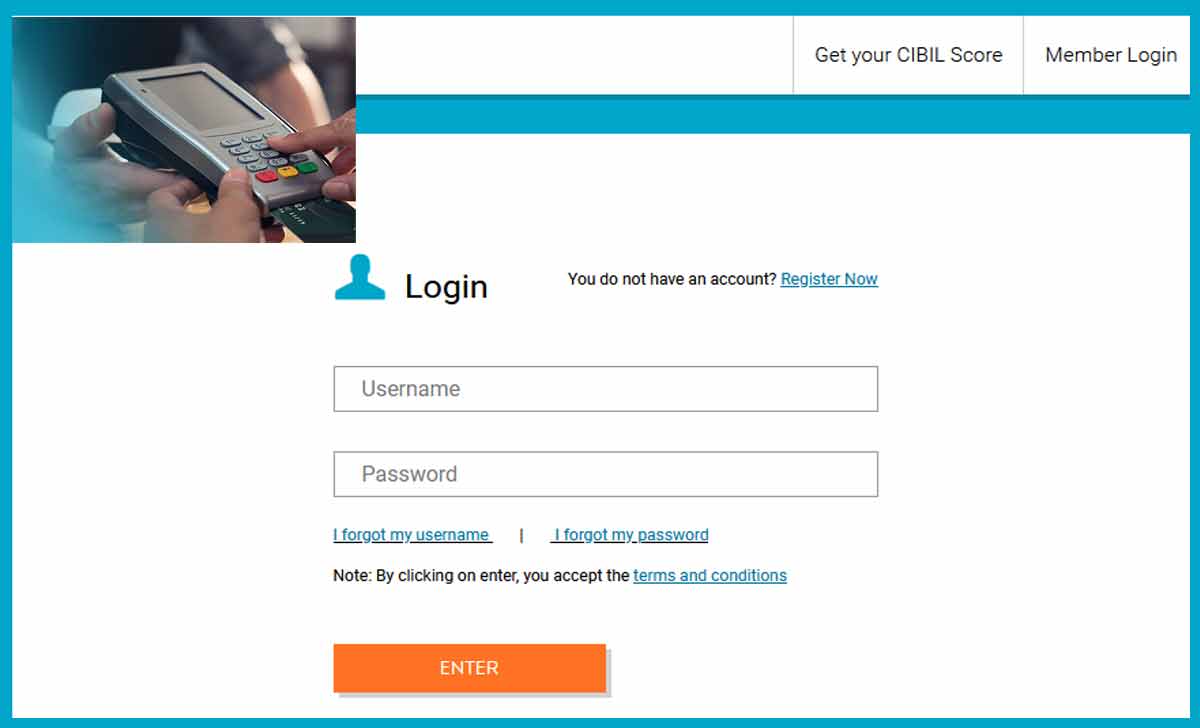

Transunion CIBIL Login

It is easy to check your CIBIL score once you have created your account and selected your membership either as free or paid. Follow the below basic steps to learn how to check your Transunion CIBIL score.

- Open this link from https://myscore.cibil.com/CreditView/login.page?enterprise=CIBIL

- Login with your account details

- Click enter

This will redirect you to your account dashboard where you can see your CIBIL Score to the left and where you stand on the right that explains your range.

We present more on Transunion Cibil score as an when happened. With this above detailed guide, you may have a clear idea about the credit score ranges. Also how you can get the score rating for paid and free membership.