Get all details of your transactions and details of tax payments paid with TDS by just downloading Form 26AS. Just check a simple guide for How to download 26AS form…

All taxpayers might be aware of TRACES and if not it is TDS centralized processing portal by the government of India. TRACES stands for TDS reconciliation analysis and correction enabling system which can be used to download different tax statements such as TDS and TCS as well. I am sure you might understand the importance of downloading 26AS TDS form?

| Topic | View Form 26AS |

| Official Site | tdscpc.gov.in/en/home.html |

| Toll Free number | 18001030344 |

| Email ID | contactus@tdspc.gov.in |

| Working Hours | 10:00 to 18:00 (Monday to Saturday) |

If not, then let me explain that Form 26AS is the reconciliation of the TDS. This can use as tax submission while filling the taxes. It is simply an easy way of collecting information for all the taxes that have been deducted from you.

I will not deep dive into what different elements and sections of Form 26AS include. But importantly show you the process for traces form 26AS download from online.

Form 26AS Download

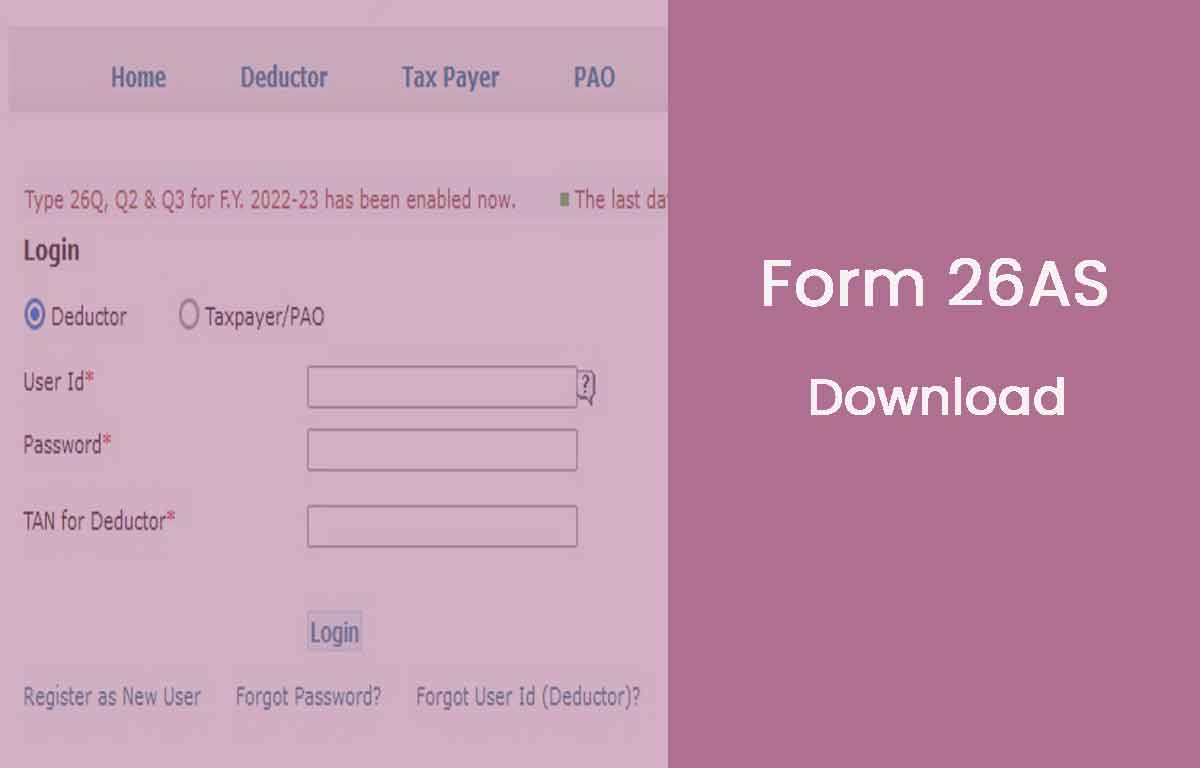

Follow the instructions below that will show you the process to view and download 26AS form from traces.

- Visit official page of TRACES income tax filing portal from https://www.tdscpc.gov.in/app/login.xhtml

- Then login with your details like User ID and password

- Click on e-FIle from the top menu and

- Tap on View Form 26AS under the Income-Tax Return option

- Simply select the assessment year and then click on the download button to save the Form 26AS download pdf

Please note that the Form 26AS with all the updated tax deduction details is available on the TRACES official portal.

Where can i get the form 26as ?

You can easily get the 26AS form from online by visiting official website of TRACES or you can go through this link tdscpc.gov.in/app/login.xhtml.

What are the mandatory factors to get 26as form ?

Users can only view the 26AS form whom map their PAN to that particular account. Also it is completely free to avail this service.

How can we view 26AS traces form without Registration?

You can view 26AS traces form from registering through income tax filing portal or you can also view it through net banking option from particular linked bank account.